503 The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi, has approved the creation of National Bench of ….

586 Non-filers of GST returns for 6 consecutive months will soon be barred from generating e-way bills for movement of ….

494 Indian businesses may soon be able to amend goods and services tax (GST) return mandated for carrying forward tax ….

634 FINANCE DEPARTMENT Madam Cama Road, Hutatma Rajguru Chowk, Mantralaya Mumbai 400 032, dated 9th January 2019 NOTIFICATION MAHARASHTRA VALUE ….

567 GST Council in the 32nd meeting held on 10th January, 2019 at New Delhi took following decisions to give ….

512 The ministerial panel under Bihar Deputy Chief Minister Sushil Modi Sunday approved levy of 1 per cent ‘calamity cess’ ….

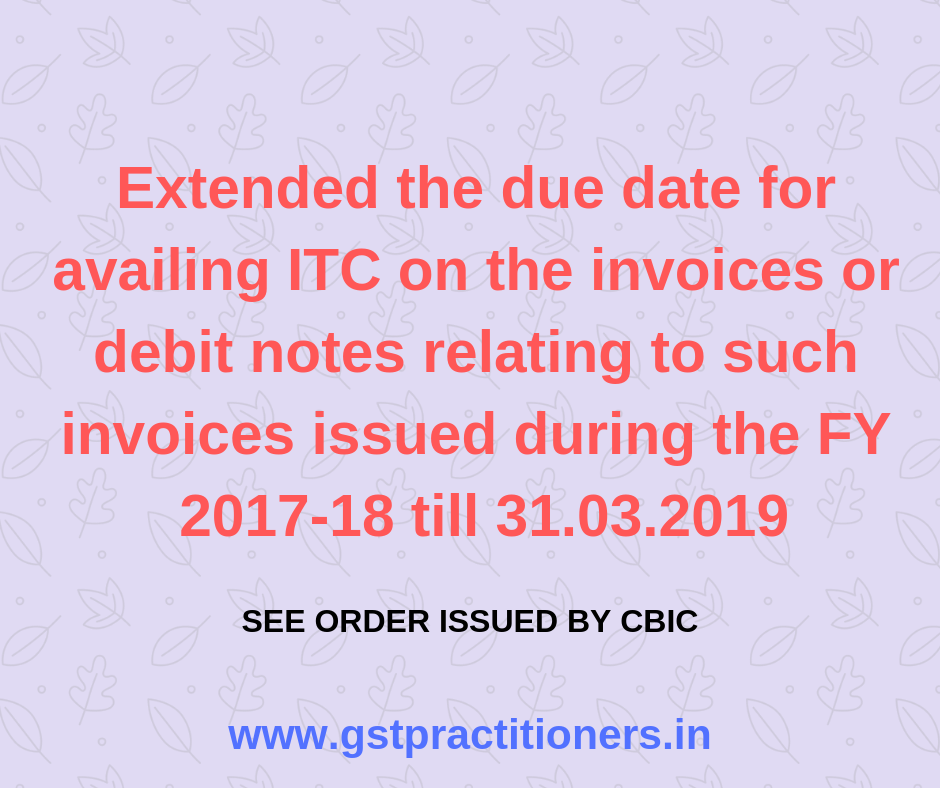

462Central Govt. on the Recommendation of 31st GST Council Meeting Extended due date to claim the ITC of Invoice to ….

718Central Govt. on the recommendation of 31st GST Council Meeting due date of GST Annual Filing & GST Audit further ….

503The Central Government, on the recommendations of the Council, hereby makes the following amendments in the notification of the Government ….

752In exercise of the powers conferred by section 128 of the Gujarat Goods and Services Tax Act, 2017 (Guj.25 of ….

![Mumbai Vat Audit Date Extended upto 28.02.2019 [Read Notification]](https://www.gstpractitioners.in/blog/wp-content/uploads/2019/01/www.gstpractitioners.in_.png)

![Govt. waived late fee of Filing of GSTR-1, GSTR-3B & GSTR-4 [Read Notifications]](https://www.gstpractitioners.in/blog/wp-content/uploads/2019/01/Waived-Late-Fee.png)