Launch of new E-filing Portal of the Income Tax Department from June 7th 2021.

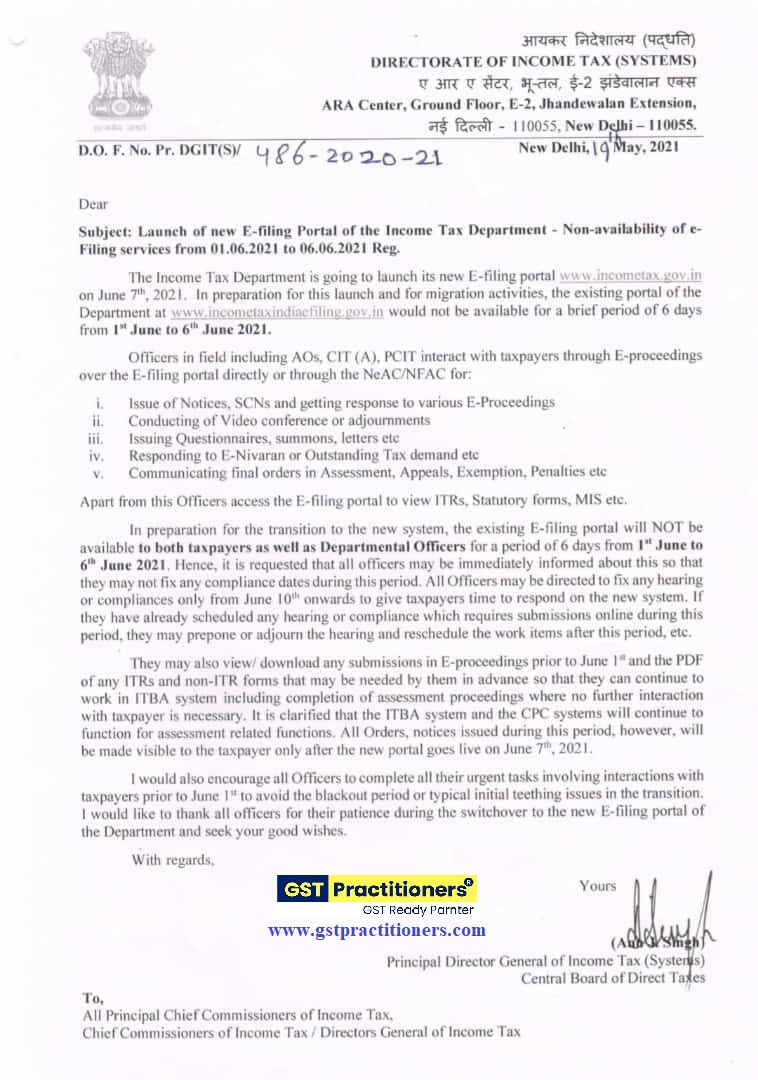

The Income Tax Department it going to launch its new E-filing portal : www.incometax.gov.in on June 7th” 2021. The portal will not be available for taxpayers as well as department officers and therefore officers have been directed not to fix any compliance dates during the six day period.

“In preparation for the transition to the new system, the existing e-filing portal will not be available to both taxpayers as well as department officers for a period of six days from June 1 to June 6′ 2021,” the notice said.

Officers in field including AOs, CIT (A), PCIT interact with taxpayers through E-proceedings over the E-filing portal directly or through the NeAC/NFAC for :

i. Issue of Notices. SCNs and getting response to various E-Proceedings

ii. Conducting of Video conference or adjournments

iii. Issuing Questionnaires, summons, letters etc

iv. Responding to E-Nivaran or Outstanding Tax demand etc

v. Communicating final orders in Assessment, Appeals. Exemption. Penalties etc Apart from this Officers access the E- filing portal to view ITRs. Statutory forms. MIS etc.

It is clarified that ITBA and CPC system will continue to function for assessment related functions. All orders, notices issued during the period will be visible to taxpayers after the new portal goes live on June 7,” the notice said.

See here Source :

K.C.MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax , Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. Her experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.