Know Pattern and Syllabus of the Examination of GST Practitioners

Know about Pattern and Syllabus of Examination of GST Practitioners.

Know about Pattern and Syllabus of Examination of GST Practitioners.

“83A. Examination of Goods and Services Tax Practitioners.- (1) Every person referred to in clause (b) of sub-rule (1) of rule 83 and who is enrolled as a goods and services tax practitioner under sub-rule (2) of the said rule, shall pass an examination as per sub-rule (3) of the said rule.

- The National Academy of Customs, Indirect Taxes and Narcotics (hereinafter referred to as “NACIN”) shall conduct the examination.

- Frequency of examination.- The examination shall be conducted twice in a year as per the schedule of the examination published by NACIN every year on the official websites of the Board, NACIN, common portal, GST Council Secretariat and in the leading English and regional newspapers.

- Registration for the examination and payment of fee.- (i) A person who is required to pass the examination shall register online on a website specified by NACIN.

(ii) A person who registers for the examination shall pay examination fee as specified by NACIN, and the amount for the same and the manner of its payment shall be specified by NACIN on the official websites of the Board, NACIN and common portal.

- Examination centers.- The examination shall be held across India at the designated centers. The candidate shall be given an option to choose from the list of centers as provided by NACIN at the time of Registration.

- Period for passing the examination and number of attempts allowed.- (i) A person enrolled as a goods and services tax practitioner in terms of sub-rule (2) of rule 83 is required to pass the examination within two years of enrolment:

Provided that if a person is enrolled as a goods and services tax practitioner before 1st of July 2018, he shall get one more year to pass the examination:

Provided further that for a goods and services tax practitioner to whom the provisions of clause (b) of sub-rule (1) of rule 83 apply, the period to pass the examination will be as specified in the second proviso of sub-rule (3) of said rule.

- A person required to pass the examination may avail of any number of attempts but these attempts shall be within the period as specified in clause (i).

- A person shall register and pay the requisite fee every time he intends to appear at the examination.

- In case the goods and services tax practitioner having applied for appearing in the examination is prevented from availing one or more attempts due to unforeseen circumstances such as critical illness, accident or natural calamity, he may make a request in writing to the jurisdictional Commissioner for granting him one additional attempt to pass the examination, within thirty days of conduct of the said examination. NACIN may consider such requests on merits based on recommendations of the jurisdictional Commissioner.

- Nature of examination.-The examination shall be a Computer Based Test. It shall have one question paper consisting of Multiple Choice Questions. The pattern and syllabus are specified in Annexure-A.

- Qualifying marks.- A person shall be required to secure fifty per cent (50%) of the total marks.

- Guidelines for the candidates.- (i) NACIN shall issue examination guidelines covering issues such as procedure of registration, payment of fee, nature of identity documents, provision of admit card, manner of reporting at the examination center, prohibition on possession of certain items in the examination center, procedure of making representation and the manner of its disposal.

- Any person who is or has been found to be indulging in unfair means or practices shall be dealt in accordance with the provisions of sub-rule (10). An illustrative list of use of unfair means or practices by a person is as under: –

- obtaining support for his candidature by any means;

- impersonating;

- submitting fabricated documents;

- resorting to any unfair means or practices in connection with the examination or in connection with the result of the examination;

- found in possession of any paper, book, note or any other material, the use of which is not permitted in the examination center;

- communicating with others or exchanging calculators, chits, papers etc. (on which something is written);

- misbehaving in the examination center in any manner;

- tampering with the hardware and/or software deployed; and

- attempting to commit or, as the case may be, to abet in the commission of all or any of the acts specified in the foregoing clauses.

- Disqualification of person using unfair means or practice.- If any person is or has been found to be indulging in use of unfair means or practices, NACIN may, after considering his representation, if any, declare him disqualified for the examination.

- Declaration of result.- NACIN shall declare the results within one month of the conduct of examination on the official websites of the Board, NACIN, GST Council Secretariat, common portal and State Tax Department of the respective States or Union territories, if any. The results shall also be communicated to the applicants by e-mail and/or by

- Handling representations.- A person not satisfied with his result may represent in writing, clearly specifying the reasons therein to NACIN or the jurisdictional Commissioner as per the procedure established by NACIN on the official websites of the Board, NACIN and common Portal.

- Power to relax.- Where the Board or State Tax Commissioner is of the opinion that it is necessary or expedient to do so, it may, on the recommendations of the Council, relax any of the provisions of this rule with respect to any class or category of Persons.

Explanation :- For the purposes of this sub-rule, the expressions –

- “jurisdictional Commissioner” means the Commissioner having jurisdiction over the place declared as address in the application for enrolment as the GST Practitioner in FORM GST PCT-1. It shall refer to the Commissioner of Central Tax if the enrolling authority in FORM GST PCT-1 has been selected as Centre, or the Commissioner of State Tax if the enrolling authority in FORM GST PCT- 1 has been selected as State;

- NACIN means as notified by notification No. 24/2018-Central Tax, dated 28.05.2018.

Annexure-A [See sub-rule 7]

Pattern and Syllabus of the Examination

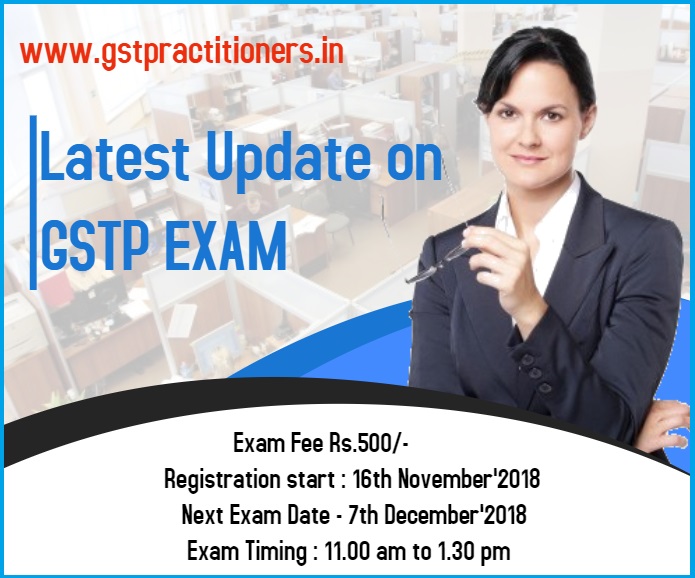

Examination for Confirmation of Enrollment of GST Practitioners to be conducted on 7th December, 2018 at designated Examination Centres across India, 01 NOV 2018 6:01PM by PIB Delhi

The GSTPs enrolled on the GST Network under sub-rule (2) of Rule 83 and covered by clause (b) of sub-rule (1) of Rule 83, i.e. those meeting the eligibility criteria of having enrolled as sales tax practitioners or tax return preparer under the existing law for a period not less than five years, are required to pass the said examination before 31.12.2018 in terms of second proviso to Rule 83(3).

The first examination for such GSTPs has already been conducted on 31.10.2018. The next examination for them shall be conducted on 7.12.2018 from 1100 hrs to 1330 hrs at designated examination centres across India.

It will be a Computer Based Exam. The registration for the exam can be done by the eligible GSTPs on a registration portal, link of which will be provided on NACIN and CBIC websites.

The registration portal for exam scheduled on 7.12.2018 will be activated on 16th November, 2018 and will remain open up to 25rd November 2018.For the convenience of candidates a help desk will also be set up, details of which will be made available on the registration portal.

The applicants are required to make online payment of examination fee of Rs. 500/- at the time of registration for this exam.

www.gstpractitioners.in

K.C.MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax , Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. Her experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.