GST Annual Return and GST Audit Return Filing Due Date Extended [Read Notification]

![GST Annual Return and GST Audit Return Filing Due Date Extended [Read Notification]](https://www.gstpractitioners.in/blog/wp-content/uploads/2019/06/CBIC-NOTIFICATION.png)

The Central Government, on recommendations of the Council, hereby makes the following Order/Notification Issued :

GST Annual Return (GSTR-9) & GST Audit Return (GSTR-9C) Filing Due Date Further Extended to 31.08.2019

To remove the difficulties, section 44 of the Central Goods and Services Tax Act, 2017, in the Explanation,

for the figures, letters and word “30th June, 2019”, the figures, letters and word “31st August, 2019” shall be substituted.

TDS Return (Form GSTR-7) Filing Due Date Extended Till 31.08.2019

The Commissioner hereby extends the time limit for furnishing the return by a registered person required to deduct tax at source under the provisions of section 51 of the said Act in FORM GSTR-7 of the Central Goods and Services Tax Rules, 2017 under sub-section (3) of section 39 of the said Act read with rule 66 of the Central Goods and Services Tax Rules, 2017 for the months of October, 2018 to July, 2019 till the 31st day of August, 2019.

Read Relevant Notification Here

Outward Supply of Goods or Services Return FORM GSTR-1 Filing Due Date Further Specified as below :

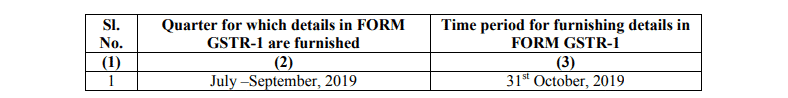

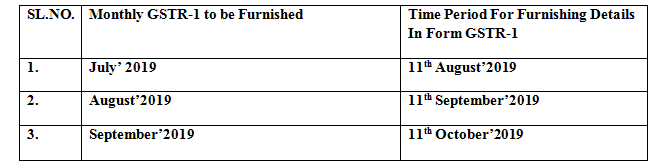

Details of outward supply of goods or services or both in FORM GSTR-1 under the Central Goods and Services Tax Rules, 2017, effected during the quarter as specified in column (2) of the Table below till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

For Turnover upto Rs.1.50 Crore :

For Turnover more Rs.1.50 Crore :

Read Relevant Notification Here

Monthly Return Form GSTR-3B Filing Due Date :

on the recommendations of the Council, hereby specifies that the return in FORM GSTR-3B of the said rules for each of the months from July, 2019 to September, 2019 shall be furnished electronically through the common portal, on or before the 20th of the month succeeding such month.

Payment of taxes for discharge of tax liability as per FORM GSTR-3B. – Every registered person furnishing the return in FORM GSTR-3B of the said rules shall, subject to the provisions of section 49 of the said Act, discharge his liability towards tax, interest, penalty, fees or any other amount payable under the said Act by debiting the electronic cash ledger or electronic credit ledger, as the case may be, not later than the last date, as specified in the first paragraph, on which he is required to furnish the said return.

Read Relevant Notification Here

The Commissioner, hereby extends the time limit for furnishing the declaration in FORM GST ITC-04 of the said rules, in respect of goods dispatched to a job worker or received from a job worker, during the period from July, 2017 to June, 2019 till the 31st day of August, 2019.

Read Relevant Notification Here

supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person as the class of registered persons who shall follow the special procedure as mentioned below :

The said persons shall not be required to furnish an annual return in FORM GSTR-9 under sub-section (1) of section 44 of the said Act read with sub-rule (1) of rule 80 of the said rules.The said persons shall not be required to furnish reconciliation statement in FORM GSTR-9C under sub-section (2) of section 44 of the said Act read with sub-rule (3) of rule 80 of the said rules.

Read Relevant Notification Here

K.C. MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax, Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. His experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.