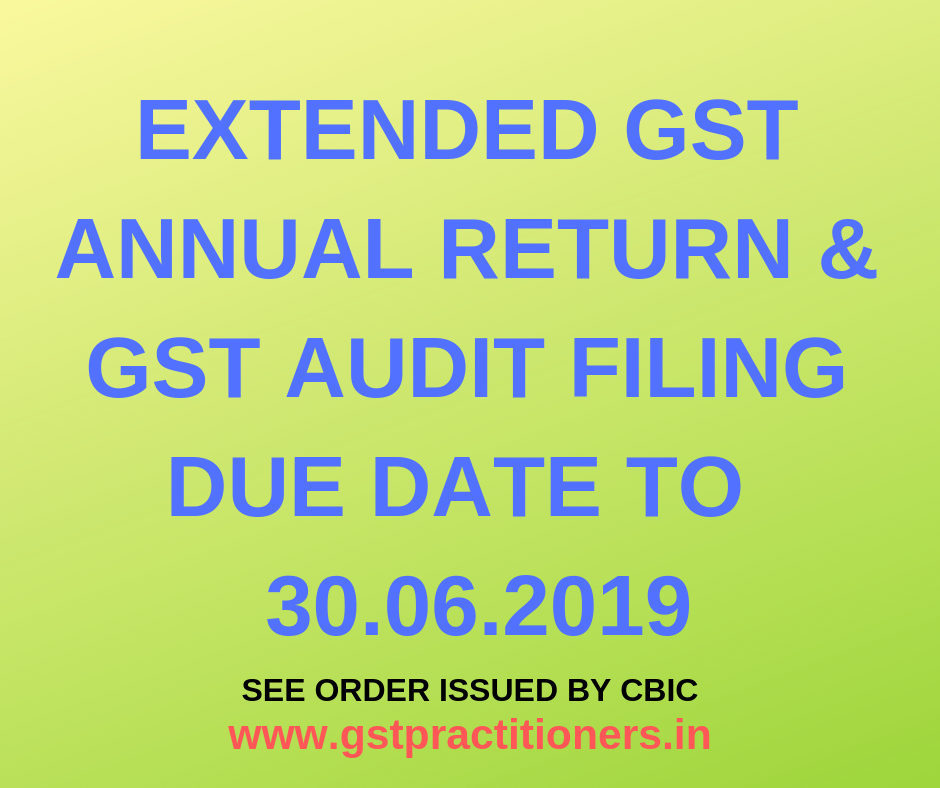

GST Annual Return and GST Audit filing Due Date further Extended to 30th June 2019

Central Govt. on the recommendation of 31st GST Council Meeting due date of GST Annual Filing & GST Audit further extended to 30.06.2019.

WHEREAS, sub-section (1) of section 44 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this Order referred to as the said Act) provides that every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirty-first day of December following the end of such financial year;

AND WHEREAS, for the purpose of furnishing of the annual return electronically for every financial year as referred to in sub-section (1) of section 44 of the said Act, through the electronic system to be developed is at the advanced stage, it may likely to take some more time for being made operational as a result whereof, the said annual return for the period from the 1st July, 2017 to the 31st March, 2018 could not be furnished by the registered persons, as referred to in the said sub-section (1) and because of that, certain difficulties have arisen in giving effect to the provisions of the said section.

Therefore Annual Return filing & GST Audit filing Due date further Extended to 30th JUNE 2019.

Read Notification :

Loading...

Loading...

K.C. MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax, Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. His experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.