GAAR AND GST DETAILS IN TAX AUDIT REPORT FORM 3CD FURTHER DEFERRED BY CBDT [Read Circular]

![GAAR AND GST DETAILS IN TAX AUDIT REPORT FORM 3CD FURTHER DEFERRED BY CBDT [Read Circular]](https://www.gstpractitioners.in/blog/wp-content/uploads/2020/04/Tiffs-Beauty-Lounge-1.jpg)

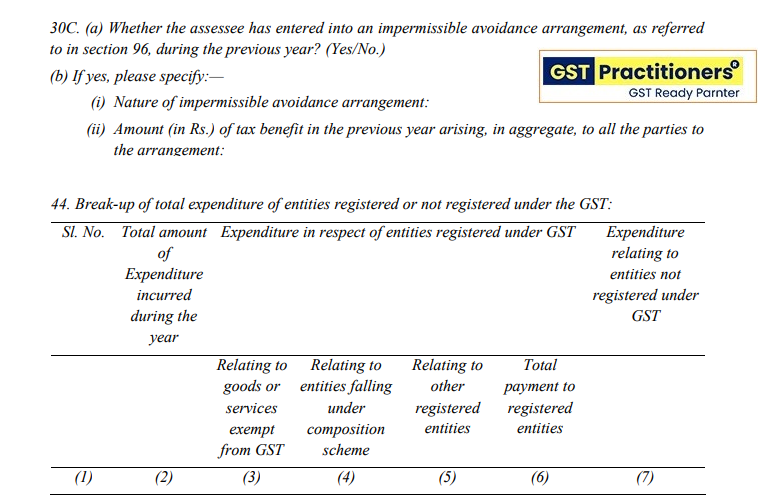

CBDT Issued order under section 119 of Income Tax Act’1961 vide circular no.10/2020,dated 27.04.2020 regarding Clause 30C (GAAR Provisions) and Clause 44 (GST Details) of Tax Audit Report -Form 3CD.

CBDT hereby further defer the Reporting Requirement of Clause 30C and Clause 44 of Tax Audit Report Form 3CD till 31.03.2021. CBDT takes steps to ease compliance for taxpayers due to COVID-19 pandemic.

following reporting details requiring in Clause 30C pertaining to General Anti-Avoidance Rules (GAAR) and Clause 44 pertaining to Goods and Services Tax Compliance, which in given in below for your consideration.

K.C.MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax , Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. Her experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.