CBIC enable the facility of NIL GSTR-3B filing through SMS [Read Press Release]

![CBIC enable the facility of NIL GSTR-3B filing through SMS [Read Press Release]](https://www.gstpractitioners.in/blog/wp-content/uploads/2020/06/Facebook-Shared-Image-Untitled-Page-1.jpeg)

CBIC enable the facility of NIL GSTR-3B filing through SMS

CBIC previously issued Notification No.38/2020-Central Tax, dated the 5th May, 2020 on the on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017,

- A registered person registered under the provisions of the Companies Act, 2013 (18 of 2013) shall, during the period from the 21st day of April, 2020 to the 30th day of June, 2020, also be allowed to furnish the return under section 39 in FORM GSTR3B verified through electronic verification code (EVC).”.

- A registered person who is required to furnish a Nil return under section 39 in FORM GSTR-3B for a tax period, any reference to electronic furnishing shall include furnishing of the said return through a short messaging service using the registered mobile number and the said return shall be verified by a registered mobile number based One Time Password facility. (new rule 67A of CGST Rules 2017).

On the Basis of above rules, CBIC enable the facility of SMS mode nil GSTR-3B filing and issued press release in this regard.

We hereby discuss the Detailed Process of SMS mode facility, but before we have to know who are liable to file GSTR-3B.

GSTR-3B is to be filed by a registered person being a

- normal taxpayer,

- casual taxpayer and

- SEZ Unit/SEZ developer.

Form GSTR-3B is not filed by those registered as an

- Input Service Distributor (ISD)

- Composition taxpayer

- Non-Resident Taxable Person (NRTP)

- Tax Deductor at Source (TDS)

- Tax Collector at Source (TCS)

- Online Information and Database access or Retrieval Services Provider (OIDAR)

Nil Form GSTR-3B for a tax period can be filed, if you:

- Have NOT made any Outward Supply and

- Do NOT have any reverse charge liability

- Do NOT intend to take any Input Tax Credit and

- Do NOT have any liability for that particular or earlier Tax Periods

- There is no saved data on GST Portal for the requested period.

- All previous returns should be filed.

- Filing is initiated after the end of tax period for which Form GSTR-3B is to be filed.

- Taxpayer’s GSTIN is active & Return period for which Nil Form GSTR-3B filing request has been made is after the date of registration.

- Return period for which Nil Form GSTR-3B filing request has been made is not after the date of cancellation of registration.

- Taxpayer has activated:

Login USER ID on the GST Portal (For Newly Registered Taxpayer)

Re-activated the login USER ID (In case of updation of the authorized signatory)

- Any authorised representative for a particular GSTIN is allowed to file Nil Form GSTR-3B through SMS.

- However, registered mobile number of authorized representative shall not be common with other authorized representatives for the same GSTIN.

Note: You will receive appropriate response message on the same mobile number from which SMS was sent, in case validation fails.

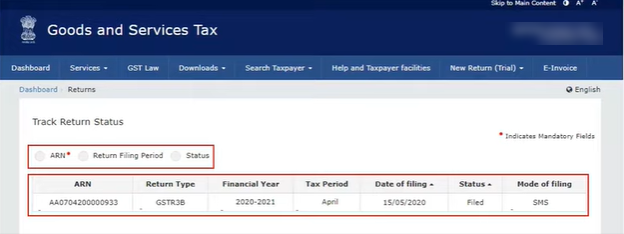

Steps to file NIL GSTR-3B through SMS ;

- Send SMS message- NIL (space) 3B (space) GSTIN (space) tax period in mmyyyy format to 14409 from your registered mobile number

- You will receive a 06 digit validation code

- Send SMS message- CNF (space) 3B (space) 06 digit verification code to 14409

- You will receive a success message with ARN No. indicating that NIL filing has been successful.

K.C.MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax , Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. Her experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.