Highlights of finance Minister’s Speech on COVID-19 Relief package of RS.20000 Crores.

Highlights of finance Minister’s Speech on COVID-19 Relief package of RS.20,000 Crores.

FOR TAXPAYERS

- TDS / TCS rates reduced by 25% on non salaried payments effective tomorrow upto 31 March 2021. Will apply to all payments – 50k Cr additional liquidity.

- All pending refunds to charitable trusts and non-corporate business & professional taxpayers (but including LLP) will be issued

- Due date for all income tax returns to be 30 November 2020 and tax audit due date to be 31 October 2020.

- Assessments getting barred on 30 September 2020 will get barred on 31 December 2020. Cases getting barred on 31 March 2021 will get barred on 30 September 2021

- Vivaad se Vishwaas scheme extended upto 31 December 2020.

- Income Tax Assessments getting barred on 30th September’2020 extended to 31st December’2020 and those getting barred on 31st March’2021 will be extended to 30th September’2021.

FOR MSME’S

- Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, including MSMEs

- To provide relief to the business, additional working capital finance of 20% of the outstanding credit as on 29 February 2020, in the form of a Term Loan at a concessional rate of interest will be provided.

- This will be available to units with upto Rs 25 crore outstanding and turnover of up to Rs 100 crore whose accounts are standard.

- The units will not have to provide any guarantee or collateral of their own.

- The amount will be 100% guaranteed by the Government of India providing a total liquidity of Rs. 3.0 lakh crores to more than 45 lakh MSMEs.

- Rs 20,000 crore Subordinate Debt for Stressed MSMEs

- Provision made for Rs. 20,000 cr subordinate debt for two lakh MSMEs which are NPA or are stressed. Government will support them with Rs. 4,000 Cr. to Credit Guarantee Trust for Micro and Small enterprises (CGTMSE).

- Banks are expected to provide the subordinate-debt to promoters of such MSMEs equal to 15% of his existing stake in the unit subject to a maximum of Rs 75 lakhs.

3. Rs.50,000 crores equity infusion through MSME Fund of Funds

- Govt will set up a Fund of Funds with a corpus of Rs 10,000 crore that will provide equity funding support for MSMEs.

- The Fund of Funds shall be operated through a Mother and a few Daughter funds. It is expected that with leverage of 1:4 at the level of daughter funds, the Fund of Funds will be able to mobilise equity of about Rs 50,000 crores.

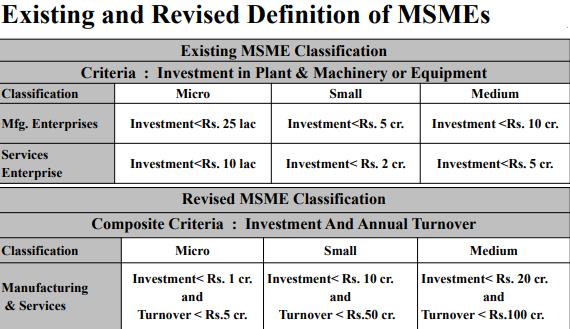

4.New Definition of MSME

- Definition of MSME will be revised by raising the Investment limit. An additional criteria of turnover also being introduced. The distinction between manufacturing and service sector will also be eliminated.

- Other Measures for MSME

- e-market linkage for MSMEs will be promoted to act as a replacement for trade fairs and exhibitions.

- MSME receivables from Government and CPSEs will be released in 45 days

FOR REAL ESTATE PROJECTS

- State Governments are being advised to invoke the Force Majeure clause under RERA. The registration and completion date for all registered projects will be extended up to 6 months and may be further extended by another 3 months based on the State’s situation.

- Various statutory compliances under RERA will also be extended concurrently.

FOR CONTRACTORS

- All central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to 6 months for completion of contractual obligations, including in respect of EPC and concession agreements.

FOR EMPLOYEES PROVIDEND FUND

- The scheme introduced as part of PMGKP under which Government of India contributes 12% of salary each on behalf of both employer and employee to EPF will be extended by another 3 months for salary months of June, July and August 2020.

- Statutory PF contribution of both employer and employee reduced to 10% each from existing 12% each for all establishments covered by EPFO for next 3 months.

FOR NBFC/HFC/MFIs

- Government will launch Rs.30,000 Crore Special Liquidity Scheme, liquidity being provided by RBI. Investment will be made in primary and secondary market transactions in investment grade debt paper of NBFCs, HFCs and MFIs.

- This will be 100 percent guaranteed by the Government of India.

Rs 45,000 crores Partial credit guarantee Scheme 2.0 for Liabilities of NBFCs/MFIs

- Existing Partial Credit Guarantee scheme is being revamped and now will be extended to cover the borrowings of lower rated NBFCs, HFCs and other Micro Finance Institutions (MFIs).

- Government of India will provide 20 percent first loss sovereign guarantee to Public Sector Banks.

FOR DISCOMs

Rs 90,000 crore Liquidity Injection for DISCOMs

- Power Finance Corporation and Rural Electrification Corporation will infuse liquidity in the DISCOMS to the extent of Rs 90000 crores in two equal instalments. This amount will be used by DISCOMS to pay their dues to Transmission and Generation companies.

- Further, CPSE GENCOs will give a rebate to DISCOMS on the condition that the same is passed on to the final consumers as a relief towards their fixed charges

No Global tenders for Government tenders of up to Rs 200 crores.

- General Financial Rules (GFR) of the Government will be amended to disallow global tender enquiries in procurement of Goods and Services of value of less than Rs 200 crores

Source : PIB 1623601

K.C.MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax , Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. Her experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.