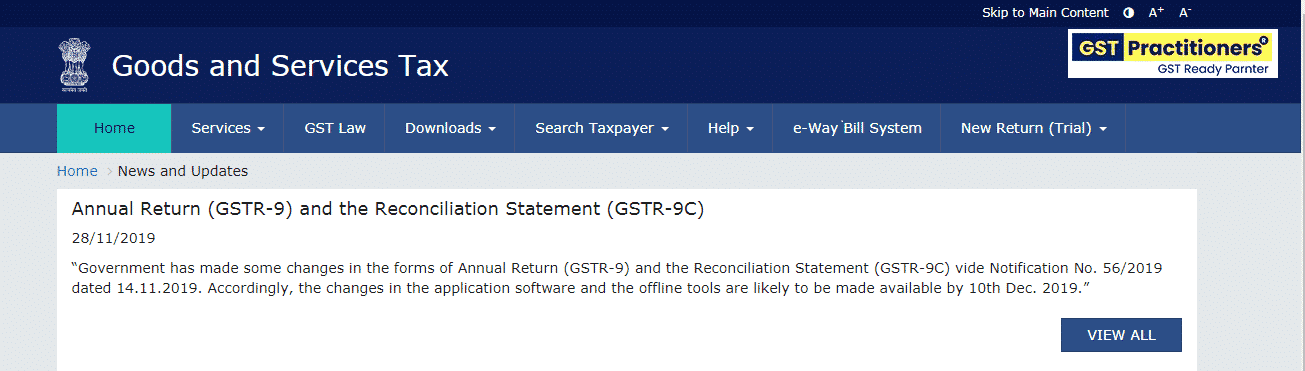

Changes in GSTR-9 and GSTR-9C available in portal by 10th Dec 2019

624

Annual Return (GSTR-9) and the Reconciliation Statement (GSTR-9c)

“Government has made some changes in the forms of Annual Return (GSTR-9) and the Reconciliation Statement (GSTR-9C) vide Notification No. 56/2019 dated 14.11.2019. Accordingly, the changes in the application software and the offline tools are likely to be made available by 10th Dec. 2019.”

Source : www.gst.gov.in

K.C. MAHATO is expert in GST Consultancy and has an experience of more than 10 years in Indirect tax, Direct Taxes and the accounting profession. He is also giving GST Practical Training to Students and SME Traders. He provide services that most effectively meet client needs. His experience is concentrated in performing GST Laws & Practices and compliances of gst in a variety of industries.