638CBIC issued notification to mandatory generation of e-Invoicing having taxpayer’s Aggregate Turnover exceeding Rs.10 Crores. please see notification :

785 HIGHLIGHTS OF THE UNION BUDGET 2022-23 The Union Budget seeks to complement macro-economic level growth with a focus on ….

687Ministry of company affairs issue circular on Relaxation on levy of additional fees in filing of e-forms AOC-4, AOC-4 (CFS), ….

1,263Recommendations of 44th GST Council Meeting Change in GST Rates on goods being used in Covid-19 relief and management ….

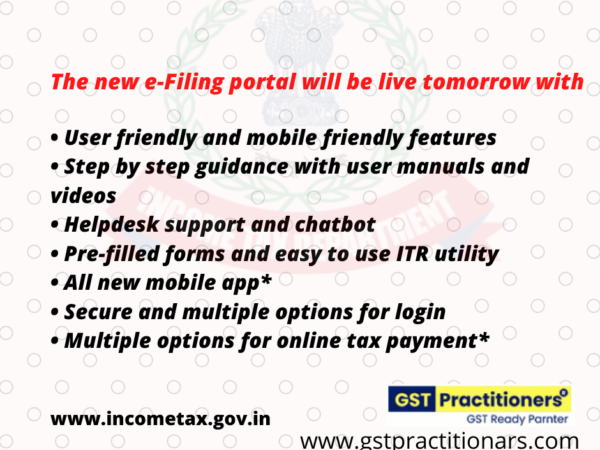

674New features in Taxpayer-friendly e-filing Portal of the Income Tax Department To Be Launched on 7th June, 2021 The Income ….

1,070 KEY DECISION TAKEN ON 43RD GST COUNCIL MEETING. The 43rd GST Council met under the Chairmanship of Union Finance & ….

857The Income Tax Department is going to launch its new e-filing portal www.incometax.gov.in on 7thJune, 2021. The new e-filing portal (www.incometax.gov.in) is ….

901 The Central Board of Direct Taxes, in exercise of its power under section 119 of the Income-tax Act, 1961, ….

1,189 The Income Tax Department it going to launch its new E-filing portal : www.incometax.gov.in on June 7th” 2021. The ….

GST Annual Return & GST Audit Report filing due date for f.y 2019-2020 further extened to 31.03.2021

768GST Annual Return & GST Audit Report filing due date for f.y 2019-2020 further extened to 31.03.2021 CBIC issued Press ….